Article

Summit: Patience will yield success

The kiosk market will not rebound from last year's economic downturn immediately, according to Summit Research Associates' latest report. But growth is out there in the next couple years.

May 12, 2002

ROCKVILLE, Md. -- Kiosk consultant Francie Mendelsohn, an optimist by nature when it comes to the kiosk industry, has had her faith tested by the economic slowdown of the past year.

The release this week of the fourth edition of Kiosk and Internet Technology, the flagship report of her consulting firm, Summit Research Associates Inc., reflects both Mendelsohn's upbeat attitude and the economy's sluggish performance. The combination is a report that is cautiously optimistic.

The bottom line: Kiosk growth has not been as great as anticipated thanks to factors outside the industry's control, but the industry will continue to grow.

"We were way too optimistic for what happened in the last year, and we said that in the first page of the report (this year)," Mendelsohn said.

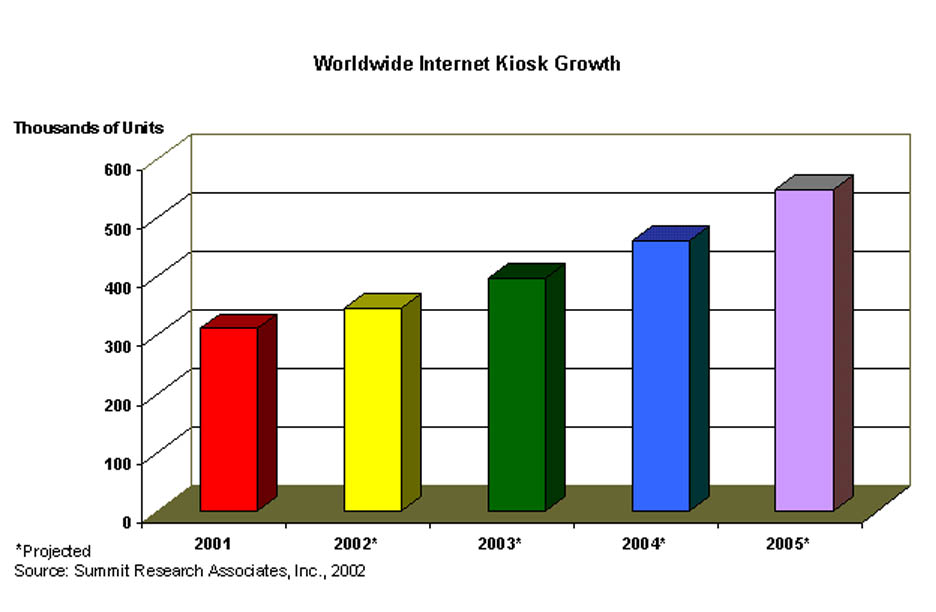

Change comes slowly in a sluggish economy, but Mendelsohn believes the industry will continue growing recession or no recession. Her study projects short-term growth will not be spectacular -- an increase from 312,000 units last year to 398,000 in 2003. But the industry will grow at a significantly greater pace a few years down the track, reaching 548,000 units in 2005, an increase of 75.6 percent over 2001.

Surprises around some corners

Mendelsohn said there are some interesting, and positive, surprises in this year's report. Perhaps the biggest surprise is the way touchscreen kiosks have flooded the market. She said past concerns about the compatibility of touchscreen monitors and kiosks have been blown away as the market embraces touchscreens. In many units touchscreens are even paired with keyboards.

|

"There are a tremendous amount of units coming out with touchscreens, something like 85 percent of them have touchscreens," she said. "The percentage of units with touchscreen is simply enormous."

Touchscreens are easy to use and as a result have gained a level of acceptance that some in the kiosk industry did not foresee.

"A couple of years ago, some of the muckity mucks were really concerned about the future of touchscreens," Mendelsohn said. "They said everyone was going to keyboards and that's just not the case. If you drew a chart on touchscreens, it would be a classic "U" chart."

Mendelsohn said another startling revelation concerned kiosk unit prices. The average cost per unit worldwide is $8,000. But in Europe, which has a greater number of deployments than in North America, it is more of a seller's market.

"One thing that was surprising to me was the cost of units. In some places it's not come down as much as I thought it would," she said. "In Europe, they are still averaging $10,000 apiece. How many units can you put out at around $10,000 a pop?"

Deployments big and small

Deployment size -- no matter how much a unit costs -- does vary, as the research in this year's report shows. According to Mendelsohn, 26 percent of the kiosk deployment companies who responded to this year's survey deploy between 101 and 500 kiosks.

|

Francie Mendelsohn |

"That's very good news, but a real good indication of the fledgling state of the industry is the number of companies that are deploying 10 or fewer kiosks," she said. "Turns out 20 percent falls into that category."

The survey showed that 39 percent of all kiosk deployment companies have between one and 50 kiosks on the market. For every Kodak Picture Maker (35,000 kiosks worldwide) and UK Jobcentres (9,000 kiosks in the UK) project, there are many deployments that consist of just a handful of kiosks.

To Mendelsohn the message is clear: The market has proven its ability, yet still has potential.

"There's a lot of room for growth and opportunity for people out there," she said.

The numbers game

The report is the largest Summit has produced, coming in at 460 pages. The company is charging $1,395 for the report, which is available as a PDF file that Summit sends out on an e-mail upon payment, or on a CD-ROM. Mendelsohn said Kiosks.org Association members will receive a discount.

The size of the report is a function of its thoroughness. Kiosk companies from 34 countries are represented. The information generated has allowed Summit to create its most voluminous report to date.

"This exceeds the one we did last year by close to 100 pages," Mendelsohn said. "Last year there were 23 charts in the report; this year there are 35. Last year 150 companies (in the kiosk industry) were profiled. This year there's something like 215."

Summit's report is the first of several expected on the overall health of the kiosk industry this year. Consulting firm Frost & Sullivan announced plans to release an industry report during the KioskCom 2002 trade show and conference this March in Orlando, Fla.